Introduction: Fostering Business Expansion through Tax Benefits

In the bustling metropolis of Dubai, Expo City stands as a beacon of opportunity for businesses seeking to showcase their products and services on a global stage. Leveraging strategic tax incentives and exemptions, Expo City offers a fertile ground for the exhibition industry to thrive. Let’s delve into the myriad benefits and opportunities available for businesses in this vibrant trade fair zone.

Exploring Tax Incentives at Dubai Expo City

Dubai Expo City presents an array of tax incentives tailored to stimulate growth and innovation within the exhibition industry. From reduced corporate tax rates to exemptions on import duties for exhibition materials, businesses operating within Expo City enjoy a competitive advantage in the global marketplace. These incentives not only attract exhibitors from around the world but also foster long-term investment and economic development within the region.

Tax Exemption in the Trade Fair Zone

One of the key attractions of Dubai Expo City is its trade fair zone, which offers significant tax exemptions for participating businesses. Companies showcasing their products and services at trade fairs within Expo City benefit from a range of tax incentives, including exemption from sales tax and VAT. This favorable tax environment encourages businesses to participate in trade fairs, driving foot traffic and boosting sales for exhibitors.

Expo Tax Benefits: Driving Economic Growth

Expo Tax Benefits in Dubai extend beyond the exhibition floor, encompassing a wide range of incentives designed to spur economic growth. From enhanced access to financing and investment incentives to streamlined administrative procedures, Expo City fosters an environment conducive to business expansion and innovation. These tax benefits empower exhibitors to maximize their potential and capitalize on emerging opportunities in the global marketplace.

Tax-Free Exhibition Opportunities: A Gateway to Success

In Dubai Expo City, exhibitors can explore tax-free opportunities that open doors to new markets and growth prospects. By eliminating the burden of taxation on exhibition activities, businesses can allocate resources more efficiently towards marketing, product development, and expansion initiatives. This tax-free environment not only enhances the competitiveness of exhibitors but also positions Dubai as a premier destination for international trade and commerce.

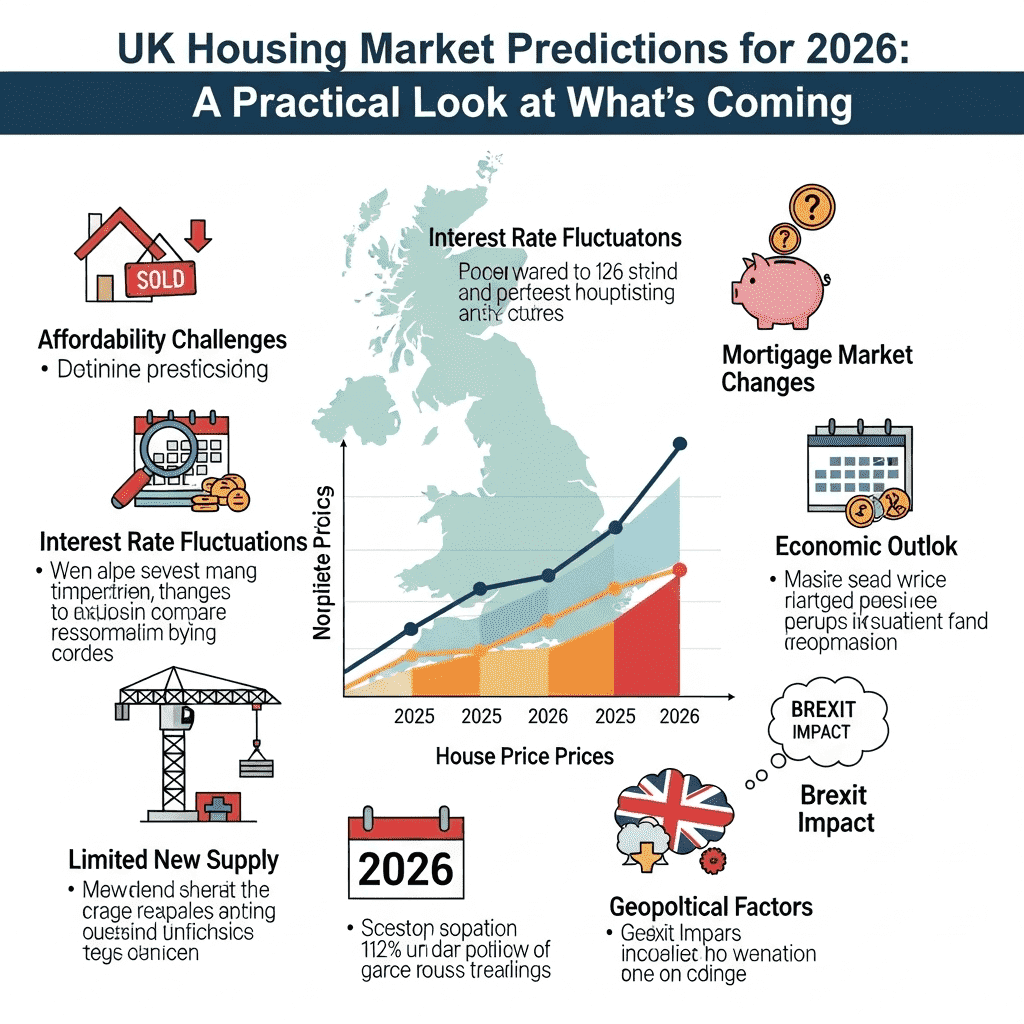

Navigating Trade Fair Tax Policies in Dubai

As businesses explore the myriad opportunities within Dubai Expo City, it’s imperative to understand and navigate the trade fair tax policies effectively. Dubai’s tax regulations are designed to promote transparency, fairness, and economic growth while ensuring compliance with international standards.

One of the key aspects of navigating trade fair tax policies in Dubai is understanding the local regulations and compliance requirements. Exhibitors must familiarize themselves with the tax laws applicable to their industry, including corporate tax rates, sales tax, and value-added tax (VAT). By staying informed about these regulations, businesses can ensure compliance and avoid potential penalties or fines.

Moreover, exhibitors should carefully evaluate their eligibility for tax incentives and exemptions offered within Expo City. Each tax incentive may have specific criteria and requirements that must be met to qualify. By conducting thorough research and seeking guidance from tax experts, businesses can determine their eligibility and leverage available incentives to their advantage.

Additionally, exhibitors must proactively manage their tax obligations throughout the duration of the trade fair. This includes accurately documenting sales transactions, maintaining proper records of expenses, and adhering to reporting requirements. By implementing robust tax compliance measures, businesses can mitigate risks and demonstrate their commitment to transparency and integrity.

Furthermore, exhibitors should stay abreast of any changes or updates to Dubai’s tax policies that may impact their operations. Tax laws are subject to revision, and staying informed about legislative developments ensures that businesses remain compliant and adaptable to evolving regulatory requirements.

Lastly, partnering with experienced professionals can greatly facilitate the process of navigating trade fair tax policies in Dubai. Tax consultants and advisors can provide valuable insights, guidance, and support to businesses, helping them navigate complex tax regulations and optimize their tax strategies. By leveraging the expertise of trusted advisors, exhibitors can navigate trade fair tax policies with confidence and maximize their benefits within Dubai Expo City.

How Bizdaddy Facilitates Corporate Tax Application

Navigating the intricacies of corporate tax application can be daunting, but with Bizdaddy, businesses can streamline the process with ease. As a trusted partner in corporate tax services, Bizdaddy offers expert guidance and support to businesses seeking to leverage tax incentives in Dubai Expo City. From tax planning and compliance to application assistance, Bizdaddy provides comprehensive solutions tailored to the unique needs of exhibitors. With Bizdaddy by your side, unlocking growth opportunities through tax incentives becomes a seamless journey towards success in Dubai’s vibrant exhibition industry.

Dubai Expo City’s exhibition industry tax incentives offer a gateway to growth and prosperity for businesses seeking to showcase their offerings on a global platform. By capitalizing on tax benefits, exhibitors can drive economic growth, foster innovation, and expand their presence in the international marketplace. With the support of trusted partners like Bizdaddy, navigating corporate tax applications becomes a straightforward process, empowering businesses to unlock their full potential in Dubai’s thriving trade fair zone.

Leave a Reply