Essay writing is a fundamental skill that every student must master. Whether you’re in high school, college, or pursuing advanced studies, the ability to articulate your thoughts coherently and persuasively through writing is invaluable. However, many students find themselves overwhelmed by the prospect of writing essays, unsure of where to begin or how to improve their writing skills. In this comprehensive guide, we’ll explore the essential steps to essay writing success, providing you with the tools and strategies you need to excel in your academic pursuits. If you require additional support or guidance along the way, consider utilizing the assistance of a professional essay service to enhance your writing proficiency and achieve your academic goals.

Introduction to Essay Writing

Essay writing is more than just a task assigned by instructors; it is a vital means of communication and expression. Essays allow students to demonstrate their understanding of course material, develop critical thinking skills, and communicate their ideas effectively. Whether you’re writing an argumentative essay, a research paper, or a reflective essay, the principles of good writing remain consistent.

Understanding the Essay Prompt

One of the first steps in essay writing is understanding the essay prompt. Before you can begin crafting your essay, you must carefully analyze the prompt to identify the specific requirements and expectations. Take note of key terms, such as “analyze,” “discuss,” or “evaluate,” which provide clues about the type of response expected.

Conducting Research

Effective research is essential for producing well-informed and credible essays. Take advantage of both online and offline resources, including academic journals, books, and reputable websites. When conducting research, be sure to evaluate the credibility of your sources and take thorough notes to facilitate the writing process.

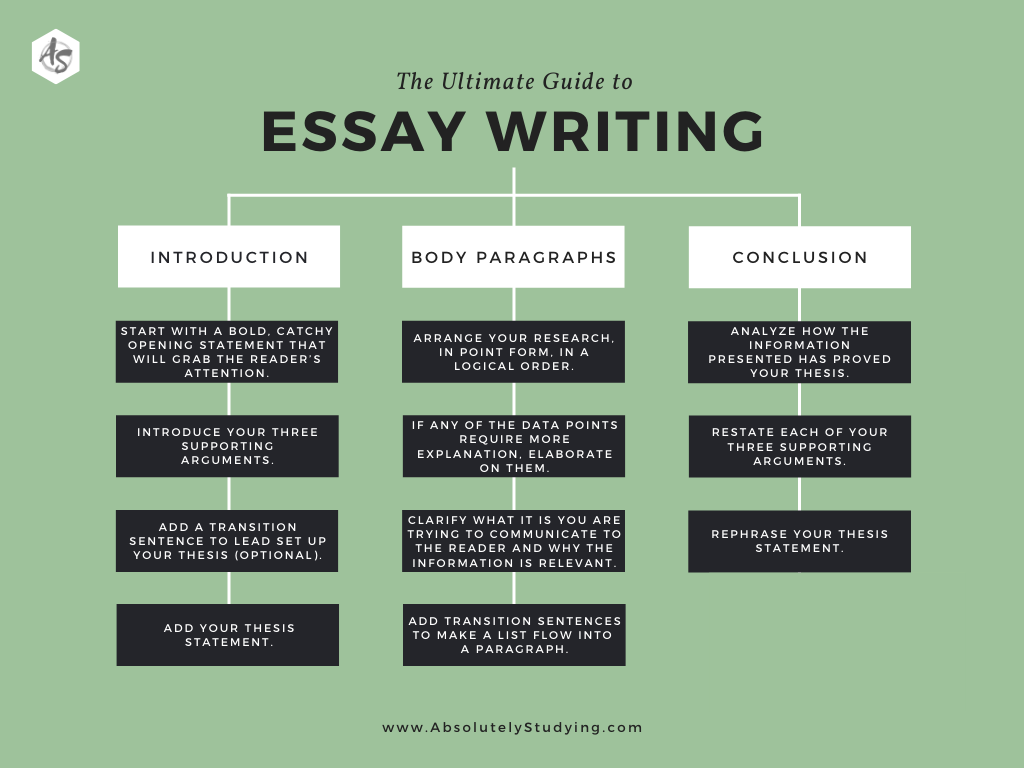

Structuring Your Essay

A well-structured essay follows a clear and logical organization, consisting of an introduction, body paragraphs, and a conclusion. The introduction sets the stage for your essay, providing context and outlining the main argument or thesis statement. The body paragraphs develop and support your thesis through the presentation of evidence and analysis, while the conclusion summarizes your findings and offers insights or implications.

Writing the Introduction

The introduction serves as the gateway to your essay, capturing the reader’s attention and providing a roadmap for what’s to come. Start with a hook—a compelling anecdote, quotation, or question to engage your audience. Then, provide some background information on the topic and conclude with a strong thesis statement that encapsulates the main argument of your essay. If you’re struggling to formulate a thesis statement, consider utilizing a thesis statement generator to help you craft a clear and concise assertion that effectively communicates the focus of your essay.

Developing the Body Paragraphs

Each body paragraph should focus on a single idea or aspect of your argument, supported by evidence and analysis. Begin each paragraph with a topic sentence that introduces the main point, followed by supporting details and examples. Be sure to use transitions to connect your ideas and maintain coherence throughout your essay.

Crafting a Strong Conclusion

The conclusion ties together the various threads of your essay, providing closure and reinforcing the significance of your argument. Summarize the main points of your essay, emphasizing the relevance and implications of your findings. Avoid introducing new information in the conclusion, but instead, leave the reader with a thought-provoking insight or call to action.

Editing and Proofreading

Revision is an essential step in the writing process, allowing you to refine your ideas and ensure clarity and coherence. When editing your essay, pay attention to grammar, punctuation, and sentence structure, as well as the overall organization and flow of your ideas. Consider seeking feedback from peers or instructors to gain fresh perspectives on your work.

Seeking Feedback

Don’t hesitate to seek feedback on your essay from trusted sources, such as classmates, instructors, or writing tutors. Constructive criticism can help you identify areas for improvement and refine your arguments. Be open to suggestions and willing to revise your essay based on feedback received.

Finalizing Your Essay

Before submitting your essay, take the time to review and polish your work. Check for consistency in formatting and citation style, ensuring that all sources are properly credited. Proofread your essay carefully to catch any remaining errors or typos, and make any necessary revisions to enhance clarity and coherence.

Overcoming Writer’s Block

Writer’s block is a common obstacle faced by many students, but it doesn’t have to derail your writing process. Experiment with different techniques to stimulate your creativity, such as freewriting, brainstorming, or taking breaks to recharge. Remember that writing is a process, and it’s okay to struggle at times—what’s important is persevering and finding strategies that work for you.

Time Management

Effective time management is crucial for completing essays on schedule and reducing stress. Break down the writing process into manageable tasks, setting realistic deadlines for each stage. Allocate sufficient time for research, drafting, editing, and revision, and prioritize your workload to meet deadlines without sacrificing quality.

Using Writing Resources

Take advantage of the various writing resources available to support your academic endeavors. Online writing guides, workshops, and tutorials can provide valuable tips and techniques for improving your writing skills. Additionally, many universities offer writing centers staffed by experienced tutors who can provide personalized feedback and assistance.

Cultivating a Growth Mindset

Approach essay writing with a growth mindset, viewing challenges as opportunities for learning and growth. Embrace feedback and constructive criticism as valuable tools for improvement, and don’t be discouraged by setbacks or mistakes. With dedication and perseverance, you can develop your essay writing skills and achieve success in your academic pursuits.

Conclusion

Mastering the art of essay writing is a journey that requires patience, practice, and perseverance. By following the steps outlined in this guide and embracing a growth mindset, you can chart your course to essay writing success. Remember that writing is a skill that can be honed and refined over time, and each essay you write is an opportunity to demonstrate your knowledge and creativity.

Leave a Reply