In the ever-evolving planet of manner, patterns come and go, however some types possess an enduring appeal that exceeds generations. One such trend that has actually created a renewal lately is actually hexagon glasses. These special eyewear items, characterized through their mathematical form, have actually caught the interest of fashion aficionados as well as innovators alike. Yet are hexagon glasses genuinely stylish, or are they merely a passing trend? Let’s examine the world of hexagon glasses to find out.

The Surge of Hexagon Glasses:

Hexagon glasses possess an exciting past history that dates back to the very early 20th century. Initially popularized through renowned numbers like soundless film star Harold Lloyd and jazz music entertainer Dizzie Gillespie, hexagon glasses were actually a symbolic representation of uniqueness as well as progressive type. Having said that, it had not been until the 1960s and 1970s that hexagon glasses experienced a considerable rise in level of popularity, because of the counterculture movement and the rise of hippie manner.

The Comeback of Hexagon Glasses:

Fast forward to the 21st century, and also hexagon glasses are once again in the spotlight. This rebirth could be credited to many factors, including the intermittent attributes of style and the influence of celebs and also influencers. Celebrities like Rihanna, Gigi Hadid, and also Harry Styles have been actually discovered showing off hexagon glasses, even further fueling their level of popularity among the masses.

Mathematical Appeal:

Some of the key factors for the long-lasting recognition of hexagon glasses is their mathematical attraction. Unlike standard round or even straight structures, hexagon glasses offer an one-of-a-kind and also unique look that prepares the individual besides the group. The well-maintained lines as well as in proportion condition of hexagon glasses add a contact of complexity and impatience to any kind of set, creating them a favorite choice for fashion-forward individuals.

Flexibility in fashion:

An additional aspect adding to the trendiness of hexagon glasses is their versatility in fashion. Whether you are actually choosing a retro-inspired appearance or even a present day aesthetic, hexagon glasses complement a vast array of clothing and also personal types. Coming from extra-large frames with tinted lenses to modern steel layouts, there is actually a hexagon glasses design to satisfy every taste and also taste.

Star Recommendation:

As pointed out previously, personality promotion plays a notable duty in shaping fashion trend fads, and hexagon glasses are no exemption. When influential have a place in the entertainment industry are spotted wearing a specific type or even device, it frequently leads to a rise in demand for that product. The common exposure of hexagon glasses on welcome mats, journal covers, and also social media sites platforms has most certainly resulted in their status as a popular manner staple.

Social Networking Site Effect:

In today’s electronic grow older, social networking sites platforms like Instagram, TikTok, and Pinterest participate in a critical function fit individual choices and driving fashion trend patterns. Influencers and also material designers regularly showcase their favored style items, featuring hexagon glasses, to their countless fans, sparking enthusiasm and interest amongst target markets worldwide. The aesthetic attributes of social networking sites makes it the excellent platform for highlighting the one-of-a-kind artistic allure of hexagon glasses and also uplifting others to include all of them right into their very own wardrobes.

Availability and Price:

Unlike some premium fashion trend fads that are actually hard to reach to the ordinary customer, hexagon glasses are actually largely on call at a variety of rate aspects, making them obtainable to folks from all walks of life. Whether you favor professional frameworks or even economical choices, there is actually no lack of hexagon glasses to select from. This access and price make it easier for individuals to embrace the style and also make it their personal.

EFE Products:

Geometric Blue Glasses E08493B

$17.99

Frame Width:142 mm / 5.59 in

Lens Width:51 mm / 2.01 in

Bridge:19 mm / 0.75 in

Lens Height:39 mm / 1.54 in

Arm Length:142 mm / 5.59 in

Product Type:Eyeglasses

Frame Shape:Geometric

Frame Material:Acetate

Gender:Women

Description:.

- The E08493B glasses feature a sleek mathematical structure concept in a sophisticated dark different colors.

- Crafted from high-grade acetate, these glasses supply both durability and style.

- On call as a structure merely, allowing you to choose your popular lens separately.

Reasons for Suggestion:.

- Geometric Type: The E08493B framework’s geometric layout is contemporary and also extremely versatile.

- Dark Different Colors: Ageless and suitable for various affairs.

- Inexpensive Costs: At only $17.99, the E08493B glasses offer excellent worth for premium glasses.

- Customer Testimonials: EFE’s outstanding premium and design have actually amassed good responses from consumers.

Geometric Multicolor-Blue Glasses E08492B

$20.99

Frame Width:143 mm / 5.63 in

Lens Width:51 mm / 2.01 in

Bridge:19 mm / 0.75 in

Lens Height:41 mm / 1.61 in

Arm Length:145 mm / 5.71 in

Product Type:Eyeglasses

Frame Shape:Geometric

Frame Material:Acetate+Metal

Gender:Women

Description:

- The E08492B glasses feature a streamlined mathematical framework concept in a fascinating multicolor-blue shade.

- Crafted from premium acetate, these glasses offer both toughness and also type.

- Available as a framework simply, allowing you to select your favored lens separately.

Explanations for Referral:.

- Geometric Style: The E08492B framework’s mathematical concept is modern-day and eye-catching.

- Multicolor-Blue: The exciting blue hue adds style as well as originality.

- Affordable Costs: At simply $20.99, the E08492B glasses deliver superb value for quality glasses.

- Consumer Customer reviews: EFE’s incredible quality and type have actually gotten positive responses from customers.

Geometric Transparent Blue Glasses E08439B

$20.99

Frame Width:133 mm / 5.24 in

Lens Width:52 mm / 2.05 in

Bridge:21 mm / 0.83 in

Lens Height:42 mm / 1.65 in

Arm Length:141 mm / 5.55 in

Temple:Spring Hinges

Product Type:Eyeglasses

Frame Shape:Geometric

Frame Material:pc

Gender:Women

Description:

- The E08439B glasses include a streamlined geometric structure style in an exciting transparent blue shade.

- Crafted from premium acetate, these glasses provide both toughness as well as type.

- Accessible as a framework simply, allowing you to pick your ideal lenses independently.

Explanations for Referral:.

- Mathematical Style: The E08439B framework’s mathematical layout is actually modern-day and stunning.

- Transparent Blue Color: The engaging blue hue adds panache as well as uniqueness.

- Cost effective Prices: At simply $20.99, the E08439B glasses provide excellent value for quality glasses.

- Consumer Testimonials: EFE’s incredible top quality and type have amassed good feedback from clients.

Geometric Black/Yellow Glasses E08221A

$19.99

Frame Width:137 mm / 5.39 in

Lens Width:54 mm / 2.13 in

Bridge:17 mm / 0.67 in

Lens Height:46 mm / 1.81 in

Arm Length:141 mm / 5.55 in

Temple:Spring Hinges

Product Type:Eyeglasses

Frame Shape:Geometirc

Frame Material:Metal

Gender:Women

Description:

- The E08221A glasses feature a streamlined mathematical frame layout in captivating blue as well as purple shades.

- Crafted coming from top quality acetate, these glasses attack a harmony between durability and design.

- Readily available as a structure merely, enabling you to choose your popular lenses independently.

Main reasons for Referral:.

- Mathematical Design: The E08221A structure’s mathematical design is actually present day and also eye-catching.

- Blue/Purple Colour: The captivating combination of blue as well as purple includes panache as well as originality.

- Budget friendly Prices: At merely $12.99, the E08221A glasses deliver exceptional value for high quality eyewear.

- Consumer Reviews: EFE’s remarkable top quality and also price have actually garnered positive feedback from customers.

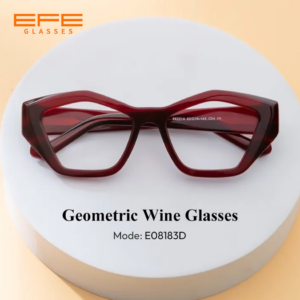

Geometric Wine Glasses E08183D

$26.99

Frame Width:145 mm / 5.71 in

Lens Width:53 mm / 2.09 in

Bridge:19 mm / 0.75 in

Lens Height:40 mm / 1.57 in

Arm Length:143 mm / 5.63 in

Product Type:Eyeglasses

Frame Shape:Geometric

Frame Material:Acetate

Gender:Unisex

Description:

- The E08183D glasses include a smooth mathematical framework style in a captivating brownish color.

- Crafted coming from top quality acetate, these glasses use both resilience and design.

- Offered as a framework just, enabling you to pick your popular lenses separately.

Reasons for Recommendation:.

- Mathematical Style: The E08183D frame’s mathematical style is actually contemporary and captivating.

- Brownish Colour: Cozy as well as versatile, ideal for several affairs.

- Cost effective Prices: At just $26.99, the E08183D glasses provide outstanding market value for top quality glasses.

- Client Evaluations: EFE’s amazing top quality and type have garnered beneficial feedback coming from customers.

Conclusion:.

Thus, are hexagon glasses stylish? The response is a definite yes. Along with their rich history, geometric appeal, convenience in style, star endorsement, social media impact, and ease of access, hexagon glasses have actually securely created on their own as an essential add-on for anybody seeking to create a fashion statement. Whether you’re a trailblazer or even a fashion trend enthusiast, incorporating a pair of hexagon glasses to your eyeglasses collection is sure to boost your design activity and also switch minds any place you go. Therefore go ahead, take advantage of the fad, and also view the globe through sophisticated geometric lens.

Leave a Reply